People are the source of our strengths. Since Otsuka's establishment in 1921, employees everywhere have pursued business guided by our enduring corporate philosophy in order to bring health to people worldwide. Through the determination of these employees, we have developed many strengths. The six strengths described below are a representative sample, and more continue to evolve each day. Making the best possible use of these strengths, employees take on new challenges to fulfill our potential, all in order to contribute to better health worldwide.

32 countries/regions

Our corporate philosophy is displayed prominently in offices in every country and region where we do business

We engage our employees to think and act creatively without preconceived notions. We also support their development, so that they can embody our unique capabilities and potential. We believe that this, as well as engagement with our corporate philosophy and managerial essence (reflected in our corporate culture) has brought us to where we are today, and will build the Otsuka of tomorrow.

As of December 2023

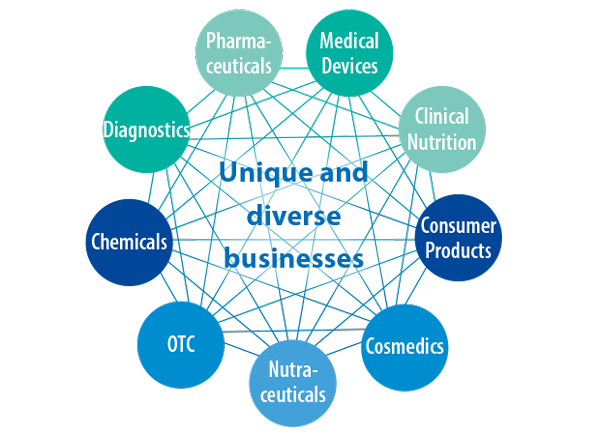

Diversification of business aimed at the resolution of health issues

We provide a variety of science-based products and services that meet the specific healthcare needs of the times in each community. We conceive products and services that will contribute in 10 or 20 years' time for people's health worldwide.

In-house drug discovery percentage: 68%1

Development projects for unmet need2:

・Psychiatry and neurology: 13 projects

・Oncology: 37 projects

・Cardiovascular and renal system: 4 project

・Other: 4 projects

We pursue the creativity implicit in our corporate philosophy across our entire value chain, from R&D through marketing. In the ongoing challenge to create innovative products and services, we are always thinking about how to generate the kind of innovation that defines Otsuka, targeting unmet medical needs as well as the yet-to-be-imagined needs of consumers.

- 1In-house drug discovery ratio among late-phase development projects (Phase 3 onward)

- 2As of December 2023; unmet needs areas defined by Otsuka based on PatientsMap2023JP and PatientsMap2023US, M3 & SSRI

Access to medicine

IV solutions business overseas companies: 173

Climate change

Countries/Regions where POCARI SWEAT is expanding: More than 20

Infectious disease

Countries/Regions where anti-tuberculosis delamanid is available: More than 120

As of December 2023

We are extending our global reach by addressing social issues (e.g., fluid/electrolyte replenishment, infectious diseases) that differ in each country/region depending on culture, customs and the times. Going forward, we will provide products and services that lead to solutions for social issues in many more countries/regions.

3Number of companies engaged in the intravenous solutions business. Many of these companies also export products to neighboring countries, thereby making a meaningful contribution to medical care in those countries.

Top-share products by pharmaceutical category4: 9 in Japan, 3 outside Japan

Percentage of consumers in Japan who have tried POCARI SWEAT: 85.1%5

We have developed our brands through unceasing efforts to demonstrate the health value of innovative products born from creative R&D. Our ability to nurture brands leads to sustainable growth and enhanced corporate value, enabling us to take on the challenge of finding original approaches to new healthcare needs.

- 4Copyright © 2024 IQVIA. Created based on annual category totals for the past 10 years, including IQVIA MIDAS 2013 to 2023 and Otsuka research. Categories defined by Otsuka. Reprinted with permission.

- 5May 2024 survey in Japan conducted by Otsuka: n=2,000

Rating by Rating and Investment Information, Inc.: AA−

Business profit margin of Nutraceutical Business: 12.4%6

TSR7 Ten Year annualized, cumulative: 107.5%

We are cultivating a solid financial foundation and strong earnings power whereby nutraceuticals and intravenous solutions generate stable earnings and act as a base, while therapeutic agents, which are a driver of growth, fund ongoing investment in creative new areas befitting Otsuka. This will form the basis for sustained investment in areas that create new value in the face of a changing business environment.

- 6Average for the previous three years (For reference: average operating profit margin of S&P Food & Beverage Select Industry Index constituents for the previous three years: 7.4%)

- 7TSR:Totalshare holder return

As of December 2023