Presentation Materials

(June 7, 2024)

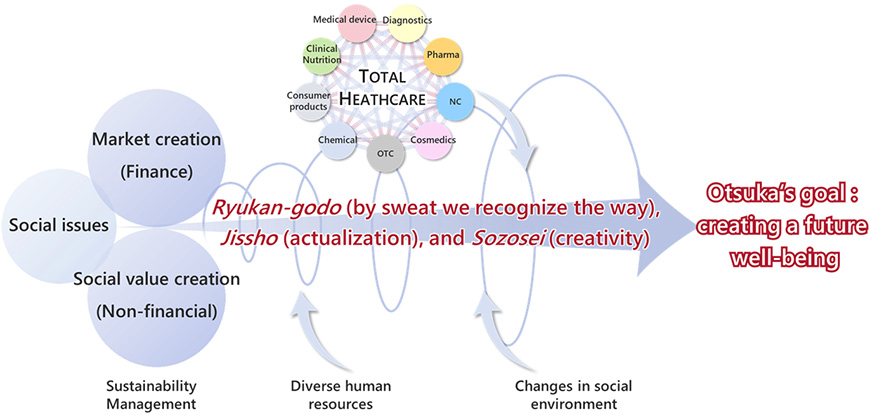

Otsuka group's vision

The Otsuka group is running business based on its corporate philosophy of “Otsuka - people creating new products for better health worldwide.” We are promoting sustainability management that simultaneously creates new markets and social value arising from social issues. Based on the diverse human resources that can embody our corporate culture of "Ryukan-godo (by sweat we recognize the way) ", "Jissho (actualization) " and "Sozosei (creativity) ", the words left by three generations of the founding family, and the diverse businesses as a total healthcare company, we will adapt to changes in the social environment and create a future Well-being that Otsuka aims for by creating unique value.

Outline of the 4th Medium-Term Management Plan(2024-2028)

Promotion of new business expansion and investment to generate growth for the next generation

-five years of creation and growth-

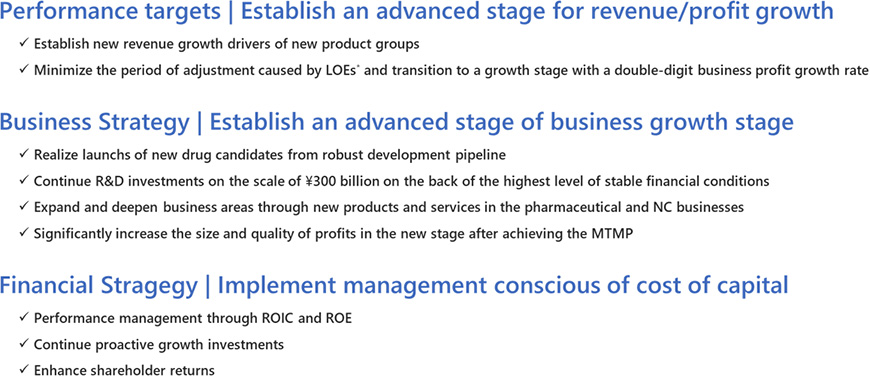

The 4th Medium-Term Management has been positioned as a five-year period to promote the expansion of new businesses and invest in next generation growth. Otsuka will focus on the three social issues of global environment, women’s health and aging society with declining birthrates based on the concept of total health care of prevention, health promotion, diagnosis and treatment. We also implement "financial strategy to support sustainable growth" and strive to achieve to improve our corporate value over the long term with a view sustainable growth through management practices that are conscious of cost of capital.

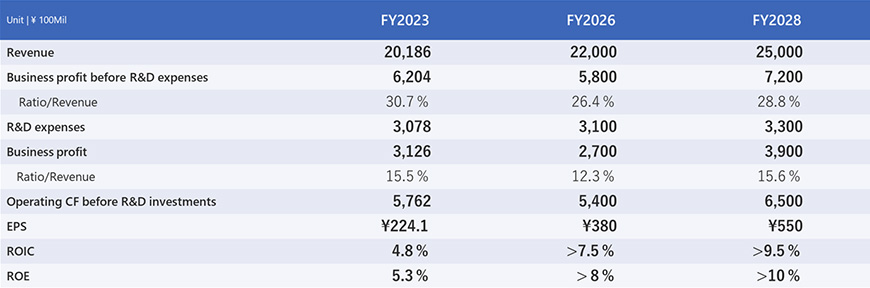

Performance targets

Revenue

Absorb the negative impact of LOEs of approx. ¥310 billion and plan to increase by approx. ¥480 billion from FY2023 to ¥2.5 trillion in FY2028 mainly driven by the growth of new drugs and NC products

R&D investment

Maintain the level of approx. ¥300 billion

Business profit

Return to a high growth phase after an adjustment period due to LOEs in FY2026

Finance

Aim to achieve financial targets of ROIC and ROE at 9.5% and 10%, respectively

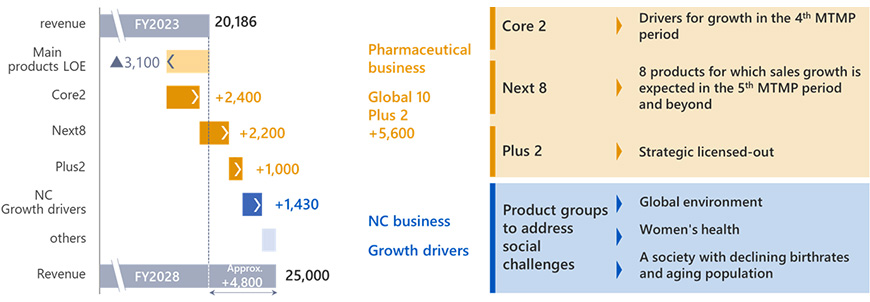

Revenue forecast for growth drivers

The revenue forecast for FY2028 is expected to reach a record high of ¥2.5 trillion, an increase of approximately ¥480 billion from FY2023 results.

· The negative impact of LOEs of approx. ¥310 billion to be largely offset by the growth of Core 2 products

· Continued aggressive R&D investment on the back of substantial late-stage drug candidates and stable cashflows

· Growth in Next 8, Plus 2 and NC products to drive net growth in this MTMP period and beyond

Revenue | Comparison between 2023 and 2028

Financial strategy

As a financial strategy that supports the cycle to enhance corporate value and the evolution of management quality, In the 4th MTMP, we will fully implement management conscious of cost of capital. The following are three areas: ①Otsuka group's ROIC management, ②Cash allocation and balance sheet management to support sustainable growth, and ③Shareholder return policy.

①Otsuka group's ROIC management

As the core of management practices that are conscious of cost of capital, we will maximize operating cash flow before R&D and optimize investment capital to improve ROIC and aim to achieve 9.5% or more by 28 (see the Performance Targets).

②Cash allocation and balance sheet management to support sustainable growth

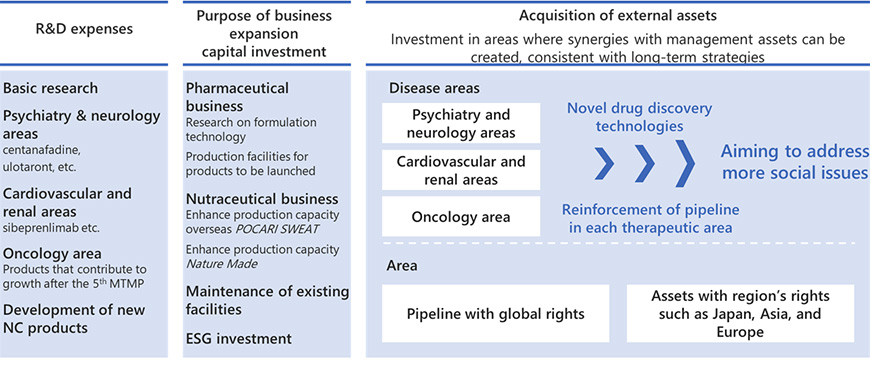

In the 4th MTMP, we will invest approximately ¥3.2 trillion, mainly ¥1.5 trillion for R&D, about ¥500 billion for capital investment, and the acquisition of external assets as growth opportunities, using the cash generated from the business as the source of funds.

We will also improve the quality of invested capital by proactively acquiring high-quality assets, which are the source of growth, and strengthen balance sheet management by efficiently utilizing and reducing business assets.

③Shareholder return policy

Our basic policy is to provide stable and continuous dividends to shareholders. We will also flexibly consider additional shareholder returns from a multifaceted perspective depending on business conditions, such as the prospect of sustainable growth in the after the 5th MTMP period.