The Otsuka group’s business operations are subject to various risks. Although the group makes every feasible effort to consider and implement preventive measures with regard to mitigating, transferring, avoiding and accepting foreseeable risk factors, it may be very difficult or impossible to ensure that all risk factors have been reduced or eliminated. If a risk event occurs, it could have a significant adverse effect on the group’s operating results and financial condition.

The group’s risk management system, and the items that the group judges to be its significant risks, are described below, but they do not purport to cover all of the risks associated with the group’s business operations. Forward-looking statements contained in these items are based on the information available as of the fiscal year end.

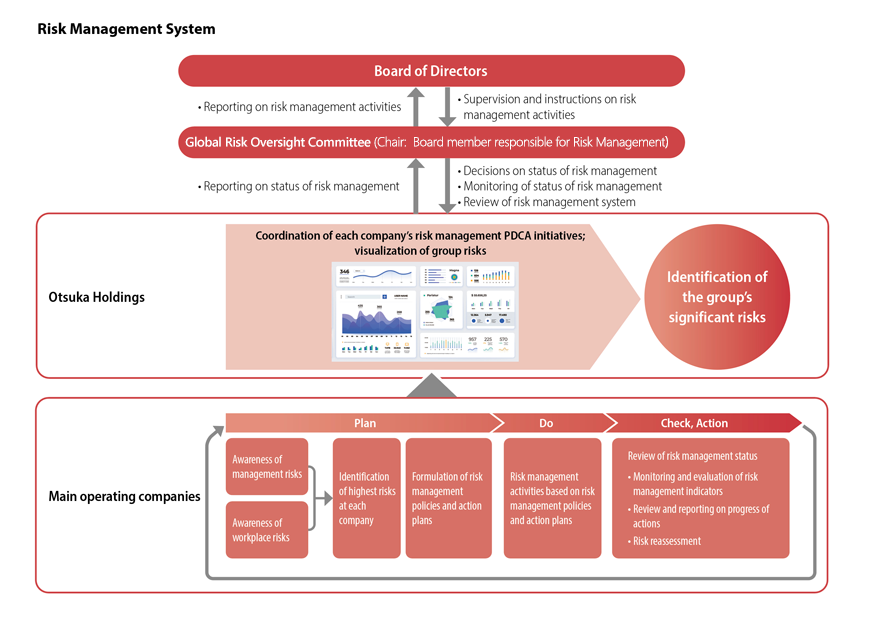

1. Risk Management System

Overview of Risk Management System

Otsuka group introduced Enterprise Risk Management (ERM) in 2020 to further enhance companywide risk management at Otsuka Holdings (the Company) and its main operating companies, including the recognition and evaluation of risks comprehensively from a company-wide perspective and the prioritization of management resources to control important risks. In 2022, the Otsuka Group Global ERM Policy was established by referencing global standards such as ISO31000 and COSO.

In the initiatives of ERM, we define “risks” as uncertainties that significantly impact the fulfillment of our corporate philosophy and the achievement of our business strategy goals, and we have established a group-wide risk management framework and a system for risk assessment. Under the framework and system, we identify and evaluate significant risks in the group through the risk assessments performed at main operating companies, determine whether to mitigate, transfer, avoid, or accept those risks, formulate management policies, and continuously execute and monitor these activities to effectively and efficiently manage the risks in the group.

The Company has established the Global Risk Oversight Committee, chaired by the director selected by the Board of Directors, and composed of our directors or executive officers in charge of finance, management planning, and general affairs. The committee participates in deliberations on significant risks and reports on them at meetings of the Board of Directors, formulates and monitors the implementation of policies for the management of significant risks, and provides instructions and support to the main operating companies when needed. The Board of Directors receives reports on committee activities, issues instructions as necessary, and oversees the effectiveness and efficacy of the group’s ERM structure.

Details of Risk Management Activities

Identification of significant risks begins with the sharing of risk awareness by senior management through interviews at the Company and the main operating companies (top-down approach), as well as assessments of risks and controls by frontline employees (bottom-up approach). This enables us to comprehensively identify the risks that exist in the group. Each group company develops risk management policies and risk management action plans for the risks that are judged to be significant risks and regularly monitors and reviews the status of those risks and the progress of action plans.

The Company aggregates and visualizes the significant risks faced by each group company to grasp a comprehensive understanding of the existing risks and the status of controls in the group. Common risks that apply to the whole group are studied closely and the significant risks are gathered and identified. Based on the results of this process, the Global Risk Oversight Committee assigns priority to significant risks that could a have significant impact on the group’s business, such as financial losses or business continuity.

The Company and the main operating companies develop and implement countermeasures to each significant risk based on the characteristics and risk tolerance. The Company provides the guidance and support to the main operating companies, which submit reports and seek advice from the Company, as appropriate. In these activities, the whole group coordinates closely to promote and practice ERM. Moreover, the Company and the main operating companies regularly monitor risks to prevent their occurrence to the extent possible and ensure that they remain within their respective tolerance levels.

2. Significant Risks

As stated in 1. Risk Management System, based on the results of group-wide risk assessments at the Company and its main operating companies, the Otsuka group recognizes the following significant risks, and is taking necessary actions including mitigation plans for risk management.

(1) Significant Risks in Core Business Areas

① Significant Risks in Pharmaceutical Business

| Healthcare Cost Containment Measure |

|---|

Overview of Risk Governments around the world indicate policies to moderate healthcare costs in order to curb the continuous increase in medical expenses. In Japan, measures such as regular drug price reductions and promotion of generic drug use have been implemented. In U.S., an important market for the group, is also pursuing policies to cut the prices of original drugs (brand-name drugs) due to the Inflation Reduction Act and to promote the use of lower-priced generics and biosimilars. The future direction of healthcare cost policies could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures The Otsuka group is working to provide innovative new drugs at appropriate prices, considering factors such as improvement of the healthcare environment, while also demonstrating the value of those new drugs. |

| Uncertainty of New Drug Development |

|---|

Overview of Risk Development of pharmaceuticals and medical devices requires substantial investments in research and development, and the drug development process, including the step of obtaining approval based on strict regulatory review, is a long-term endeavor. Delay or suspension of development due to, for instance, inability to confirm the expected efficacy and safety in clinical trials, could shorten the period of patent exclusivity, allow competing products to reach the market first, or cause us to abandon efforts to market developed products. As a result, the Otsuka group would be unable to obtain revenue commensurate with research and development expenses, which could have an adverse effect on medium-to-long-term business plans. Moreover, a decline in profit margins or recording of impairment losses on assets due to a failure to achieve the expected operating rate of facilities in which the group invested could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures In addition to its priority areas-the psychiatry and neurology areas, the oncology area, and the cardiovascular and renal areas, the Otsuka group concentrates on research and development focusing on unmet medical needs which have not satisfied yet, and is enhancing its pipeline, with the aim of raising the probability of success for development projects in the priority areas. The group enhances monitoring clinical trials, and if problems are recognized, implements countermeasures in cooperation with the relevant departments. |

| Side Effects |

|---|

Overview of Risk The Otsuka group’s pharmaceuticals, medical devices and other products may cause unexpected serious side effects that would affect the safety profile of the product. In that case, the group may be required to respond with measures such as discontinuation of development, discontinuation of sales, revising the package insert or recalling the product, which could have an effect on revenue and development plans for the entire business. |

Countermeasures In addition to the portfolio management measures described above, the group has a global organizational structure for safety management, has established global operational procedures, and ensures the collection of safety information through measures including employee training. In all countries/regions where the group's pharmaceuticals, medical devices, and other products are developed and sold, safety information collected by group companies, alliance partners, or others is managed in a global database of all group companies. Safety information is evaluated properly from medical perspective and reported appropriately to authorities in accordance with the regulations of each country/region, and a system has been established for implementing safety measures. |

| Quality |

|---|

Overview of Risk To provide high-quality products, the Otsuka group thoroughly implements manufacturing and quality control compliant with regulations in each country and works continuously to strengthen its quality assurance system. Regular checks and evaluations of quality assurance systems are also implemented for contract manufacturers and raw material suppliers to ensure product quality equivalent to that of the group. |

Countermeasures The Otsuka group is committed to developing and acquiring technology, nurturing human resources, and persistently pursuing the pinnacle of quality in order to stably supply safe and reliable products to all people. The group keeps cultivating Quality Culture under the "Otsuka Group Quality Policy", aligned with regulations in each country and region, and strengthens the quality system based on the "ICH Q10 Pharmaceutical Quality System Guidelines". Each operating company is constantly working to enhance its quality assurance system by conducting quality control tests for each manufacturing process and ensuring the reliability of data under a quality policy for each characteristic, and thoroughly implementing traceability. In addition, the group has established articulate standards for quality control and certification for the business partners including manufacturing and raw material suppliers, and conduct regular confirmations and evaluations of manufacturing management and quality assurance systems based on strict audit standards to ensure product quality as well. |

② Significant Risks in Nutraceutical Business

| Expansion into New Categories and New Regions |

|---|

Overview of Risk In Nutraceutical Business, the Otsuka group is working on contributing to social issues from a global perspective, creating and promoting growth drivers for the next generation, and maintaining a high-profit margin system, under the theme of “becoming a global company with resilience providing health solutions aligned with each life stage”. However, there is the risk that products developed to capture customers' unmet needs may be unsuited to the market, as well as risks in new regions relating to legal regulations, economic conditions, political instability, and uncertainty in the business environment. If such risks were to realize, they could have a significant adverse effect on the company performance and business plans. |

Countermeasures In sustaining and enhancing brand value in its various markets, the Otsuka group has kept eye on the change of market environments from the perspectives of both macro and micro level. Based on the unique characteristics of each product and region, the group tries to mitigate risks from the long term viewpoints of optimizing out strategy as needed. |

| Food Safety and Quality (also applies to Consumer Products Business) |

|---|

Overview of Risk In domestic and international markets, the food industry has faced problems in recent years, such as contamination with harmful substances. The occurrence of an incident that exceeds the group’s quality control capacity could have a significant adverse effect on the Otsuka group’s operating results, financial condition and social trust. |

Countermeasures The Otsuka group is committed to developing and acquiring technology, nurturing human resources, and pursuing the pinnacle of quality in order to stably supply safe and reliable products to all people. The group keeps cultivating Quality Culture under the "Otsuka Group Quality Policy" which is aligned with regulations in each country and region, and working to acquire ISO 9001 (for quality) , ISO22000 and FSSC 22000 (for food safety) certifications. Each operating company is consistently committed to implementing production management and quality control, ensuring the reliability of data, thoroughly enforcing traceability, and strengthening the quality assurance system to achieve continuous quality improvement based on its respective policies. |

(2) Significant Risks Common to All Business Areas

| Group Governance and Strategy |

|---|

Overview of Risk Failure to fully realize the benefits from governance under the holding company structure, such as appropriate allocation of resources, planning and review of group strategies, monitoring and supervision of group companies, and group company administration via the main operating companies in business execution in and outside Japan, could have a significant adverse effect on the Otsuka group's operating results and financial condition. Moreover, inability to procure funding as planned or a rise in funding costs due to changes in global economic conditions could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures In the Otsuka group, strategic decisions and allocation of resources appropriate for the group as a whole are made based on reports of business operations from group companies and analysis of those reports. The group's core businesses are the Pharmaceutical Business and the Nutraceutical Business. In the Pharmaceutical Business, the group concentrates on priority areas such as psychiatry and neurology, oncology, and cardiovascular and renal areas, focusing on unmet medical needs that have not yet been satisfied. In the Nutraceutical Business, the group prioritizes the allocation of management resources, mainly operating functional drinks, foods, and supplements that support the maintenance and enhancement of daily health. Furthermore, to adaptively interpret changes in domestic and international market environments and respond appropriately, the group examines the possible existence of various risks, and promptly reports the findings to management. Specifically, the group focuses on proposing solutions based on new concepts that address substantial needs and social issues, and creating original products and services based on its unique and diverse businesses. In addition, the group's distinctive and diverse products enable it to disperse its overall business risk and respond to changes in the market environment related to changes in personal consumption trends. The Company also enacted the “Otsuka Group Global Code of Business Ethics” and related global policies, and is using these as the basis of standardized training throughout global operations, which in turn will lead to the creation of a system for the collective control of group companies. Based on matters prescribed in the Regulations of the Board of Directors and the Affiliated Company Management Regulations, information from domestic and overseas group companies is collected and exchanged regularly, and by requiring the approval of the Company for important matters, a group cooperation framework has been established. In addition, the Company periodically conducts internal audits of domestic and overseas group companies, and has built a monitoring framework and established a group-wide internal reporting system. The group maintains good relationships with financial institutions and is proactively diversifying its funding sources, and raises funds through bond issues and other methods as necessary. The group also maintains line of credit commitments with multiple financial institutions as a precaution against the event that it is unable to raise sufficient funds using these methods due to market disruption. In addition, it makes timely revisions to funding plans based on the most current information. |

| Human Capital Recruitment and Development, and Immersion of Corporate Culture and Corporate Philosophy |

|---|

Overview of Risk If the corporate culture and corporate philosophy are not sufficiently understood, and if the Otsuka group is unable to secure human capital who can operate its businesses in accordance with the group's strategies, competitiveness and operating results could be adversely affected in the long term. Furthermore, if the group is unable to secure sufficient human capital to carry out critical and high-level strategies such as overseas expansion, M&As and alliances, as well as digital transformation (DX), the group's competitiveness and profitability may not grow as expected, while incidents of misconduct may occur and appropriate responses may not be implemented, which could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures The Otsuka group, under the leadership of our executives, provides programs for employees across the entire group, at a global level, to learn the necessary qualities and business skills required for management. The group continuously creates human capital capable of business operations based on the group and global strategies. Additionally, through the immersion of corporate philosophy and the cultivation of corporate culture, the group enhances the engagement of all employees, creating an environment where they can maximize their abilities, and the group is developing systems to evaluate and improve these efforts. Furthermore, to continuously create innovation and strengthen corporate competitiveness, the group focuses on securing and retaining research and development human capital, fostering digital talent, and promoting diversity as declared in the "Otsuka Group Global Code of Business Ethics." The group has established systems and mechanisms to support the active participation of diverse human capital. The group also promotes flexible working styles under a hybrid work system that incorporates diverse working methods, establishing systems to facilitate smooth communication among employees. Moreover, to clarify the basic principles of the internal whistleblowing system and enhance its effectiveness, the group has established the "Otsuka Group Global Speak-Up Policy" and are working to cultivate a speak-up culture through education and awareness activities. |

| Human Rights |

|---|

Overview of Risk In the global trend of respecting human rights, laws mandating responses to human rights risks are spreading across various countries. Human rights risks refer to the risk of human rights abuses for all individuals involved in business activities. If left unaddressed, these risks can lead to reputational risks, such as loss of trust from customers and society, operational risks such as business stagnation, termination of transactions with business partners, and disruption of supply chains, legal risks including lawsuits and administrative penalties, and financial risks such as divestments and decline in stock prices. These risks would significantly impact the Otsuka group's performance and sustainability. |

Countermeasures Under the "Otsuka Group Global Code of Business Ethics" the Otsuka group complies with the United Nations "Guiding Principles on Business and Human Rights" and established the "Otsuka Group Human Rights Policy" in 2020. The group has identified important human rights issues for each stakeholder as "Salient Human Rights Issues for Otsuka Group" and under the leadership of the Otsuka Group Human Rights Promotion Officer (Director of Otsuka Holdings), the Otsuka Group Human Rights Task Force promotes activities. To respect human rights and create a positive impact on society, the group is building mechanisms for respecting human rights in collaboration with independent external experts. The group conducts human rights risk assessments in our supply chain, then we directly confirm and investigate these risks through dialogue with external stakeholders to ensure proper management as necessary. Internally, the group also provides employees education on human rights and conduct regular monitoring. Additionally, the group has established anonymous internal whistleblowing hotlines for each company, as well as the hotline for external stakeholders to anonymously report inappropriate incidents, including fraud and human rights issues, recognized in transactions and contractual relationships with our group companies. The group collaborates within the group to investigate and appropriately address to reported incidents. |

| Environmental Issues |

|---|

Overview of Risk Regarding climate change due to global warming, unexpected incidents such as extreme heat, droughts, and floods would lead to a decrease in the yield of raw material crops, resulting in increased procurement costs. Additionally, if the transition to de-carbonization would not properly executed, there would be a rise in energy costs due to carbon taxes and a decline in international competitiveness, which might significantly impact our group's performance and sustainable growth. |

Countermeasures Under the Otsuka Holdings Environmental Committee, the Otsuka group has established environmental policies and goals, including the "Otsuka Group’s Environmental Policy" and "Activity Guidelines." These initiatives are implemented and expanded through the "Otsuka Group Global Environmental Council," which consists of directors of production departments and Environmental management officers at operating companies of the group. To address financial risks such as increased procurement costs due to climate change and rising energy costs from carbon taxes, the group conducts scenario analyses based on TCFD recommendations. The group evaluates the financial impacts and resilience of our strategies, review and deepen our policies and strategies, and strive to mitigate these risks. |

| Supply Chain Transparency |

|---|

Overview of Risk In the supply chain, encompassing the Otsuka group's own operations as well as contract manufacturers, suppliers of raw materials, logistics companies, and sales companies, the occurrence of inappropriate conduct related to human rights, labor, the environment, anti-corruption, or sustainability in general could force a review of the group's business execution framework, harm the group's brand value or credibility, and have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures The “Otsuka Group Global Code of Business Ethics” requires all people involved in the Otsuka group’s business activities to act with high ethical standards. In procurement activities, the group has established the "Otsuka Group Procurement Policy," which articulates the selection of suppliers in a fair, impartial, and transparent manner, compliance with relevant laws and regulations, and acting with high ethical standards based on social norms. Additionally, to ensure quality, safety, and stable supply, and to build an ethical and sustainable supply chain, the group has formulated the "Otsuka Group Sustainable Procurement Guidelines" With the consent of suppliers, the group confirms the status of measures for each item, and conducts monitoring and other activities. In addition, the group established the “Otsuka Group Business Partner Code of Ethics” in 2024 for all business partners. |

| Corporate Brand Management |

|---|

Overview of Risk Failure to properly cultivate and manage the Otsuka group's corporate brand may adversely affect the group's image. The spread through social media of inappropriate expressions in the group's advertisements or other media, or the spread of criticism or misinformation about the group's business activities or image could lower the group's brand value or credibility, depending on various factors, which could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures To properly cultivate and manage the group's corporate brand, the Company established rules for use of the corporate brand at each group company, and promotes initiatives for management of the corporate brand and maintenance and improvement of its value. The group's corporate symbol is managed primarily by the CI* Management Committee in accordance with unified group rules. |

* CI: Corporate Identity

| Business Alliances and Acquisitions |

|---|

Overview of Risk Business alliances and acquisitions conducive to the group's key growth strategies may not produce the expected group synergy due to the change of operating environment after the alliance or acquisition is made, resulting in dissolution of the alliance or financial losses. In that event, the dissolution of the alliance or the recording of impairment losses on goodwill or intangible assets due to inability to realize the anticipated benefits from the acquisition or alliance, could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures In order to make appropriate business alliances and acquisitions and pursue subsequent sustainable growth, the group conducts detailed due diligence and valuation of the target companies or assets, holds extensive discussion by the Board of Directors, and monitors business operations after the alliance commences or acquisition is completed. The group also engages outside experts when necessary, and works on human capital development with the ability to implement. |

| Digitalization |

|---|

Overview of Risk If the group's digitalization policy and support measures are not carried out effectively, delays in DX at the group's operating companies may prevent the group from securing a competitive advantage or expanding its market share. This could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures By harnessing its collective capabilities, the group is striving to introduce advanced technology with a sense of urgency, primarily in group companies and business divisions. As specific measures, the group is conducting proof-of-concept demonstrations and practical application in a variety of contexts, from the research, production and sales fields, to smartphone apps for patients. ln addition, measures are being taken to raise the base level of lT knowledge and skills group-wide by holding seminars for employees on the latest technologies, such as Al, machine learning and loT, to improve their lT literacy, and by sharing successful case studies throughout the group. |

| Natural Disasters and Pandemics |

|---|

Overview of Risk Physical damage caused by a large-scale natural disaster, including earthquakes, tsunamis, typhoons, and floods, or a pandemic, such as COVID-19, could have a significant adverse effect on the Otsuka group's operating results and financial condition. Adverse effects could include interrupted operation of the group's factories, research laboratories, business sites, or other facilities, loss of human resources, delays in the development of new products due to suspended clinical trials in the Pharmaceutical Business, decline in product sales due to inability to appropriately provide treatments to patients, and decline in sales of products in the Nutraceutical Business and other segments due to reduced consumption. |

Countermeasures The Otsuka group formulates business continuity plans (BCP) to continue its business activities to the extent possible and maintain stable supplies of products even in the event of a major earthquake or other disaster. Specifically, in preparation for natural disasters, the group has established a system for confirming the safety of employees and their families, ensures channels of communication between group companies, maintains stockpiles of emergency supplies, and conducts regular drills. From the standpoint of business continuity management (BCM), group companies are cooperating to create a framework for business continuity across the group in production, orders, logistics and other operations, securing proper raw materials and product inventories, and working to strengthen measures such as multi-sourcing systems, alternate production systems and logistical systems. As part of these efforts, group companies jointly conduct BCP exercises, setting new themes each year. |

| Raw Material Price Hikes |

|---|

Overview of Risk The prices of key raw materials used in the Otsuka group's products fluctuate due to factors including weather, natural disasters, market prices, economic conditions, fuel costs, and exchange rates. If prices rise significantly due to these or other causes, it could increase the manufacturing costs of the affected products or make raw materials unprocurable, which could have a major adverse effect on the group's operating results and financial condition. |

Countermeasures To mitigate risks associated with key raw materials price hikes, the Otsuka group implements various countermeasures as a general principle, including purchasing raw materials from multiple suppliers, gathering information on market conditions for raw materials including upstream raw materials, securing alternative raw materials, maintaining appropriate inventory levels, and improving productivity to reduce costs. In addition, after implementing such countermeasures, the group can also address raw material price increases by passing on those increases to sales prices. |

| Infringement of Intellectual Property Rights |

|---|

Overview of Risk Expected earnings may not eventuate if the intellectual property rights that are held by the Otsuka group or licensed to the group by other companies are infringed by a third party. Also, the group might be required to conduct product recalls, terminate manufacturing or sales, and/or pay substantial amounts of compensation if a product manufactured or sold by the group is determined to have infringed a third party’s intellectual property rights. |

Countermeasures The Otsuka group has systems in place to properly manage intellectual property rights, including patents. Through continuous monitoring, the group remains alert to the risk of infringement of its intellectual property rights by third parties. The group also conducts investigations and gathers information using outside experts, databases and investigative organizations to remain alert to the risk of infringement of the intellectual property rights of third parties. In addition, should an intellectual property dispute arise, the group takes steps to minimize the impact on its businesses in cooperation with the relevant parties inside and outside the group. |

| Litigation |

|---|

Overview of Risk Regarding the Otsuka group’s business operations, there is a possibility that a suit may be brought relating to product liability, labor issues, infringement of intellectual property rights, breach of contract, environmental pollution, or other issues. Any judgment, decision or settlement unfavorable to the group could result in a significant adverse effect on the group’s operating results, financial condition, business strategies and social trust. |

Countermeasures The Otsuka group has established an internal reporting system to monitor signs of possible litigation. The Company’s Legal Affairs Department also exchanges information with group companies for responding and supporting appropriately. Furthermore, the Company consults with outside counsels as necessary to reduce litigation risk. |

| IT Security and Information Management |

|---|

Overview of Risk There are various causes including system failures, accidents, cyber-attacks, and acts of negligence by employees or third parties such as outsourcing contractors that may result in system outage. This could lead to interruption of business activities, tampering with information, misuse or leakage. It could have a significant adverse effect on the group's operating results, financial condition, and social trust. |

Countermeasures The Otsuka group has established the “Otsuka Group Global Information Security Policy” which outlines our basic approach to information management and security. The group aims to ensure that all group companies recognize the importance of information management and security, and the group strives to thoroughly disseminate its importance through education and training for our executives and employees. Also, in the form of countermeasures against various cyberattacks and related threats, the group is strengthening its security infrastructure and establishing processes for governance, identification, defense, detection, response, and recovery across the group as a whole. In addition, we conduct security assessments for each group company, visualize the management situation, identify issues, and strive for continuous security enhancement through improvements. Meanwhile, a Computer Security Incident Response Team (CSIRT) has been established to enable responses to information security incidents. |

| Global Business Operations |

|---|

Overview of Risk Outside of Japan, the Otsuka group conducts business operations mainly in the U.S., Europe and Asia, including research and development, manufacturing and sales activities. In the course of these global business activities, the occurrence of risks including changes or tightening of legal regulations in each country, changes in economic conditions, political instability, and uncertainty in the business environment, could lead to stagnation in business activities or delays or cancellation of business expansion. This could have a significant adverse effect on the group's operating results and financial condition. Also, in the event of sudden contingencies relating to geopolitical factors, it is anticipated there could be impacts related to securing the safety of employees, their family members and others, as well as to employment. These situations too could have a significant adverse effect on the group's operating results and financial condition. |

Countermeasures The Otsuka group works to mitigate risks in global expansion by assessing local business environments and business conditions and geopolitical risk impacts, and, as needed, reviewing management strategies from a long-term perspective, while ensuring relevant departments collaborate appropriately in responding to these issues. |

| Geopolitical Risk |

|---|

Overview of Risk The Otsuka group conducts business activities in various regions around the world, and as a result, the group might be significantly affected by rising geopolitical tensions. In recent years, the strengthening of economic security legislation in various countries and regions, including increased regulations on critical information and materials, as well as restrictions on logistics due to international conflicts, have created an environment where heightened geopolitical tensions greatly impact corporate activities. |

Countermeasures The Otsuka group closely monitors the political, economic, and social conditions in each region, establishing systems to recognize and respond to risks earlier. We regularly analyze and visualize the impact on the group's business activities, review and continuously update our BCP in planning of emergencies, and promote the optimization of the entire supply chain. Additionally, through fair, impartial, and transparent procurement policies and building good relationships with suppliers, the group strives to achieve stable procurement and supply, and stabilize the supply chain. |